Journey Security Ideas

Choosing journey insurance coverage could be a very complicated a part of planning your worldwide journey. Is it definitely worth the expense? Which insurance coverage firms supply the very best protection?

Getting some journey insurance coverage is a particularly necessary a part of planning a visit to overseas nations. Many common medical health insurance firms don’t cowl a lot (if something) if you journey. This implies you can purchase a devoted journey insurance coverage plan.

Journey insurance policy can cowl a mixture of medical emergencies, accidents, theft of non-public property, sickness, and even journey cancellation or interruptions. It’s only a good possibility if you wish to journey safely nowadays.

However the very best half is, first rate plans can price only some {dollars} a day.

After 10-years of journey, I’ve had fairly a couple of incidents occur on the highway (Dengue Fever, a stolen digital camera, telephone, and so on.) So I by no means journey with out insurance coverage to guard me from these surprising conditions.

My purpose with this journey insurance coverage information is that will help you slim down the overwhelming decisions on the market — and decide some good journey insurance coverage whether or not you’re touring for 2-weeks or 6-months.

Sorts Of Journey Insurance coverage

There are a couple of completely different sorts of journey insurance coverage, and a few plans cowl greater than others.

You’ll must ask your self a couple of questions earlier than choosing a plan. Are you a short-term traveler going away for every week or two? Or are you a long-term traveler leaving for 6-months or extra?

Do you carry numerous costly photograph/laptop gear, or not?

Will your present medical health insurance cowl you abroad? How a lot will it cowl? Does it embody medical evacuation? Do you’ve got any pre-existing situations?

Are you the kind of one that books motels/flights/actions prematurely? Or do you simply wing it and pay for these companies as you utilize them? Are you apprehensive your journey may get canceled?

Journey Medical Insurance coverage is protection for accidents, accidents, sickness, or hospital visits while you’re away from dwelling.

Medical Evacuation Insurance coverage is protection for emergency transportation (typically through airplane) to a serious hospital for higher therapy.

Journey Cancellation Insurance coverage is protection for surprising interruptions in your journey plans.

Baggage/Property Insurance coverage is protection for theft or injury to your gear whereas touring.

Greatest Journey Insurance coverage Choices In 2022

Brief-Time period Journey Insurance coverage

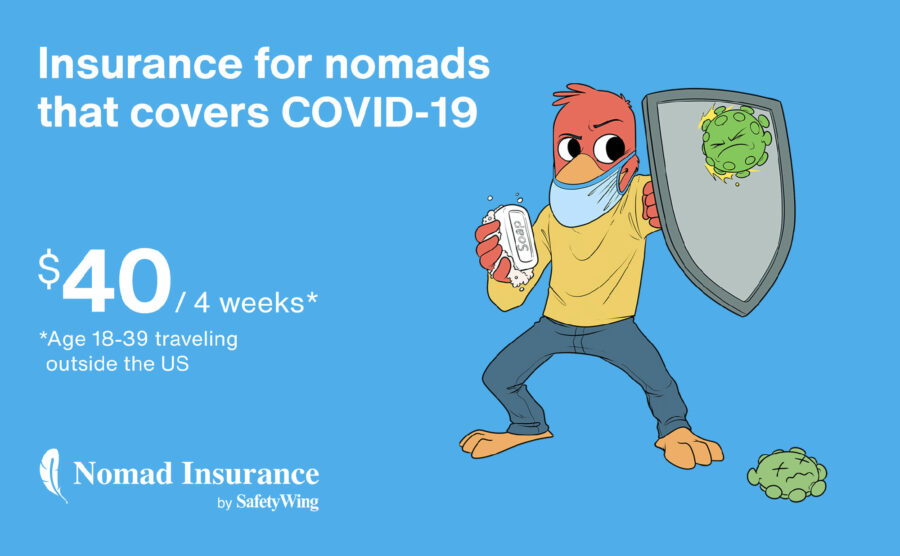

SafetyWing

SafetyWing is a improbable price range journey insurance coverage possibility for vacationers. They provide the flexibleness to buy a plan earlier than or after your journey has already began. Plans begin at solely $40 per thirty days, and so they embody theft of non-public property too!

One other huge perk is that they will additionally cowl you in your house nation, or a dependent youngster who’s touring with you. Which is sweet for digital nomads and households touring with youngsters.

Professionals

- Brief or long-term insurance policies

- Very reasonably priced plans

- Covers individuals as much as 69 years outdated

- Covers COVID-19

- Covers kids at no cost

- On-line declare submitting

Cons

- Primary emergency protection

- Restricted protection for private belongings

- Restricted protection for journey actions

- Solely covers journey interruptions

- $250 deductible

World Nomads

World Nomads focuses on short-term journey protection, together with theft, and are very fashionable amongst vacationers. I used them for years earlier than I made a decision to get long-term expat kind insurance coverage as an alternative.

Shopping for insurance coverage with World Nomads in your subsequent trip is fast & simple. You may even buy a plan with little superior discover. You may prolong protection on-line from anyplace too.

Well being Protection Worldwide: Sure.

Protection At House: No.

Medical Evacuation: Sure.

Journey Cancellation: Sure.

Theft/Harm Insurance coverage: Sure. ($500 per-item restrict)

Lengthy-Time period Insurance coverage For Digital Nomads & Expats

As a result of I’m a digital nomad and journey with 1000’s of {dollars} of digital camera tools for work, I’ve a extra long-term journey insurance coverage mindset. I exploit an expat devoted medical health insurance coverage, mixed with a gear coverage for skilled photographers.

This combine is costlier than a World Nomads Coverage, however works finest for my long-term journey life-style.

IMG International

This plan focuses on long-term worldwide medical protection, however doesn’t cowl theft or journey cancelation. Protection inside the US is included, however to qualify you could spend at the very least 6 months of the yr dwelling overseas. You may select a deductible from $250-$10,000.

Well being Protection Worldwide: Sure.

Protection at House: Sure.

Medical Evacuation: Sure.

Journey Cancellation: No.

Theft/Harm Insurance coverage: No.

Instance Quote: International Gold (1 yr coverage) = $74/month with $1000 deductible

HTH Worldwide

Full worldwide medical insurance coverage, together with the US. No limits as to how lengthy you’re within the US. Deductible waived for normal physician checkups. Wonderful insurance coverage, however expensive. Sherry from OttsWorld.com is a cheerful buyer.

Well being Protection Worldwide: Sure.

Protection at House: Sure.

Medical Evacuation: Sure.

Journey Cancellation: No.

Theft/Harm Insurance coverage: No.

Instance Quote: International Citizen (1 yr coverage) = $269/month with $1000 deductible

Extra Insurance coverage Choices

Your Present Well being Insurance coverage

Have already got common medical health insurance in your house nation? Examine to see if they supply protection internationally. In the event that they do, you may not want anything.

Owners Or Renters Insurance coverage

Your householders or renters insurance coverage could cowl your belongings if you’re touring in overseas nations too. Name them as much as confirm the small print.

Credit score Card Journey Insurance coverage

Many journey bank cards typically embody some fundamental journey, theft, and even automotive insurance coverage (which is nice for renting a automotive abroad). Name your card firm as much as get particulars on what is strictly coated (or not).

Do You Want Journey Insurance coverage?

That is the million-dollar query — and in the end a private choice. I’ve met loads of individuals who journey with out journey insurance coverage and I’ve contemplated doing the identical.

However after over 10-years of fixed journey, listening to horror tales from different vacationers, and stepping into a couple of harmful predicaments myself — if somebody asks for my opinion on the topic I reply with:

YES. Everybody ought to carry some type of well being/property insurance coverage when touring.

Why? As a result of stuff occurs. Whether or not you suppose it’s going to or not. Regardless of your best-laid plans and preventative measures. Positive, in the event you sprain your ankle, it may not be a giant deal.

However what in case your appendix bursts? Or your bus crashes? Otherwise you contract a plague? Or require medical evacuation after breaking your leg?

These items positively occur to vacationers infrequently, and will price you tens (or tons of) of 1000’s of {dollars}. With out insurance coverage, you’re screwed!

My suggestion relies on listening to numerous first-hand tales of catastrophe from different vacationers, in addition to my very own private experiences.

Actual-Life Examples

I do know a girl touring in Costa Rica who fell off a ladder, shattering her arm. She didn’t have medical health insurance, obtained horrible therapy on the native hospital, and was mainly held hostage there till she was capable of pay the HUGE medical invoice.

One other individual I do know misplaced the whole lot he was touring with when his locked guesthouse in Ecuador was damaged into. With out private property insurance coverage, he would have wanted to spend 1000’s changing all his gear.

One other pal contracted a flesh-eating parasite whereas trekking via the jungles of Peru. He required months value of therapy from specialised docs, and a medical evacuation flight again to the US.

These are all individuals I do know personally.

Making An Insurance coverage Declare

Insurance coverage firms are infamous for attempting to keep away from paying out claims. Making a declare may take some work in your half, relying on the scenario. Listed here are a couple of suggestions for getting paid via journey insurance coverage:

- For those who’re having points submitting a declare, all the time work your method up the company ladder. Discuss to a supervisor. Then speak to the supervisor’s supervisor. Make your declare points public utilizing Social Media if wanted.

- Document conversations. Initially of each telephone name, inform the opposite get together you’re recording the dialog to make sure no misunderstandings later.

- When submitting a police report of any sort, hold the story easy. The longer and extra in-depth the report, the simpler it’s for insurance coverage firms to discover a loophole to disclaim your declare.

Extra Journey Insurance coverage Ideas

- Learn the high quality print first! Know what you’re coated for. For instance, some insurance policies don’t cowl excessive sports activities or theft of unattended objects.

- Take images or a video of all of your journey gear with a date stamp.

- Save PDF copies of any journey gear purchases & hospital receipts. Hold originals too.

- Write down serial numbers, coverage numbers, and insurance coverage contact info.

- Retailer this info on-line in a safe, simple to entry place. I exploit Evernote. One other good possibility is Dropbox or Google Drive.

- File a police report instantly after any theft or accident whereas touring.

Nobody likes to consider theft or damage after they’re on trip, however the risk is actual, and with out good journey insurance coverage, an surprising incident may destroy the remainder of your yr. By no means journey with out it! ★

Take pleasure in This Article? Pin It!

READ MORE TRAVEL SAFETY TIPS

I hope you loved my information to the very best journey insurance coverage choices for vacationers. Hopefully you discovered it helpful. Listed here are a couple of extra wanderlust-inducing articles that I like to recommend you learn subsequent:

Have any questions on getting journey insurance coverage? What about different recommendations? Be a part of the dialog on Fb, Instagram, or Twitter to share!