Utilizing bank cards, debit playing cards, and ATMs in Europe has really gotten loads easier, extra user-friendly, and safer over the previous couple of years—however there are nonetheless a number of quirks you must find out about so that you don’t run into any hassle. On this information, I’ll cowl all the pieces that you must find out about utilizing cash in Europe so you possibly can keep away from fraud and extra charges, in addition to methods to make sure you at all times have entry to cash.

Visa And Mastercard The Most Extensively Accepted Credit score Playing cards

Visa and Mastercard are each accepted almost all over the place in Europe that takes bank cards.

American Specific is accepted at higher-end companies however you’ll nonetheless discover fairly a number of locations that received’t settle for Amex, so it shouldn’t be your main card.

Uncover is just not broadly accepted in Europe so it shouldn’t be your main card.

Be sure your debit and bank cards have the Cirrus or Plus emblem on them—almost each Visa or MasterCard has one. Playing cards with these logos will largely work anyplace in Europe.

Backside line: Use both Visa or Mastercard when touring in Europe.

Contactless Cost vs. Chip-and-PIN vs. Swipe & Signal Playing cards

Contactless card funds have change into the usual in Europe so retail staff will default to presenting you with this feature.

Chip-and-PIN playing cards are additionally broadly accepted so at a naked minimal you desire a Chip and PIN card (so that you’ll additionally have to know your PIN code).

Paying by swiping your bank card and signing the receipt isn’t accomplished in Europe (solely US nonetheless does this). Some bank card terminals can nonetheless take swipe playing cards however lots of the newer ones aren’t designed to just accept them.

Utilizing Your Smartphone (Apple Pay & Google Pay) Is The Most secure Approach To Make Purchases in Europe

Absolutely the most secure solution to pay for issues in Europe is through your smartphone with Apple Pay or Google Pay.

It’s because Apple Pay and Google Pay encrypt all of your information so there isn’t a manner for scammers to steal/intercept your card particulars if you make purchases. In reality, your card particulars are by no means really saved in your telephone—as an alternative, a singular one-time-use encrypted code is created for every transaction and that code (not your account quantity) is transmitted to authorize the transaction.

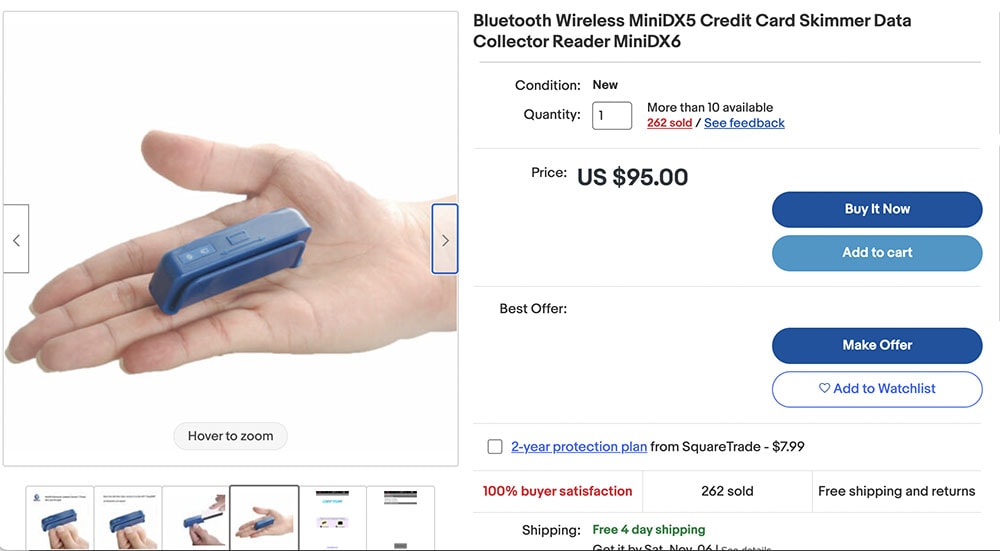

Bodily bank cards and debit playing cards might be simply skimmed (i.e. copied) as a result of the knowledge saved on the cardboard’s magnetic strip isn’t encrypted and might thus be immediately copied with a card reader.

Moreover, bodily playing cards have a built-in chip that transmits the playing cards’ data wirelessly and these might be learn with a easy scanner that wirelessly scans the sufferer’s cost card. That’s why you must hold your playing cards in RFID-blocking wallets, purses, sleeves, and so forth.

Plus, you possibly can arrange two-factor identification for all cellular transactions (fingerprint, face ID, passcodes, and so forth.) so as to add one other degree of safety.

You can too load your debit and ATM card onto your telephone so you should use your telephone to withdraw money from most ATMs (a majority of European ATMs are additionally contactless).

As an added bonus, on my newest journey, I had fraudulent fees on my debit card so my financial institution canceled my debit card and mailed me a brand new card to my house tackle. However, they had been capable of robotically replace my debit card in my Apple Pockets so I may nonetheless withdraw money on the ATM with my debit card through my iPhone/Apple Pay. All the course of took about an hour and I didn’t need to do something.

Is Apple Pay & Google Pay Extensively Accepted In Europe?

Sure, a really massive proportion of outlets of all sizes all through Europe have transformed to contactless funds so any of those retailers ought to have the ability to settle for each Apple Pay and Google Pay.

In line with Visa, over 90% of in-store Visa funds in Europe at the moment are contactless.

On my current journey to France, I believe I used Apple Pay 99% of the time—even for small purchases.

Even many automated machines like metro/practice ticket kiosks and merchandising machines settle for contactless cost.

After all, there are nonetheless some companies that also solely settle for money and a minority may need a minimal buy for bank card purchases.

That mentioned, at all times have a bodily card readily available to be protected.

FUN FACT: You do not want any kind of web connection to make use of Apple/Google Pay as a result of they use NFC chip (Close to Area Communications) to switch the cost data to the shop’s terminal—which requires no web connection.

Solely Use Money owed Playing cards at ATMs and Solely Use Credit score Playing cards to Make Purchases

By no means use bodily DEBIT playing cards to pay for issues. Solely use your DEBIT card (or Apple/Google Pay) to withdraw cash from ATMs — that’s it.

And solely use CREDIT playing cards (or money or Apple/Google Pay) to pay for issues if you journey.

However why?

As a result of European vacationer hotspots have an enormous downside with card skimming (i.e. waiters and shopkeepers use card readers to make immediate copies of your playing cards). However you additionally need to watch out about utilizing an ATM as a result of thieves can set up hidden skimmers on the ATM which is able to copy the cardboard particulars of anybody who makes use of it.

Your debit card is immediately tied to your checking account so scammers can drain your checking account in a short time. Moreover, it’s a lot more durable to get well this cash and it could actually take days or even weeks to get labored out along with your financial institution.

Your financial institution will then cancel your debit card in the event that they see fraudulent purchases — which suggests you’ll don’t have any entry to money since you received’t have the ability to use your card to withdraw cash from the ATM.

Nonetheless, in case your bank card is compromised you’ll nonetheless have the ability to get money through your debit card/ATM. Plus, bank card firms received’t maintain you answerable for fraud.

Keep away from Credit score Playing cards With Overseas Transaction Charges

Many bank cards cost a international transaction price of anyplace from round 2%-3% of every transaction — which may rapidly add up.

There are a variety of bank cards that don’t cost any international transaction charges in order that’s one thing to look into.

Nonetheless, a few of these playing cards cost an annual price which could offset the advantage of not charging international transaction charges so seek for a card that doesn’t cost an annual price as nicely.

Keep away from Paying Extreme Overseas ATM Charges

Except your financial institution offers you free ATM withdrawals, try to be conscious that your financial institution will cost you a price for withdrawing money in Europe.

Fortunately, most European ATMs don’t cost a price on their finish however your house financial institution in all probability will.

Anticipate your financial institution to cost you between $2-$5 per withdrawal—which may actually add up should you make a number of small withdraws. That’s why I like to recommend taking out bigger chunks of money so that you pay fewer charges. Personally, I often withdraw round $100-$150 at a time and attempt to keep away from utilizing money till the final a part of my journey so I don’t need to withdraw money as a lot.

Moreover, don’t be shy about asking your financial institution to refund one or two of those international ATM transaction charges as most will typically do it. Be taught extra about Overseas ATM charges.

Hold Your Playing cards Separate & Have A Backup Credit score Card

I at all times journey with a backup bank card simply in case one thing does occur and my financial institution cancels my main card due to theft or fraudulent purchases.

I hold this card separate from my different playing cards so if my pockets will get stolen I’ll nonetheless have entry to cash.

Name Your Financial institution Earlier than Touring

I used to be shocked that many banks lately don’t require you to name them forward of time to allow them to know that you just plan on utilizing your card whereas touring to Europe — I suppose their algorithms are getting so good that they’ll higher spot fraudulent purchases. Personally, each Chase and my Apple Card mentioned I didn’t have to allow them to know.

However it’s nonetheless price trying into simply to be protected.

ATM Methods and Scams

One of the best ways to get money is through the ATM and fortunately they’re all over the place in Europe. However there are some things that you must know that may assist prevent cash.

Use ATMs From Massive Banks

First, solely use ATMs from massive banks (HSBC, BNP Paribas, Crédit Agricole, Banco Santander, Barclays, Deutsche Financial institution, and so forth.) since these banks are a lot much less prone to pull scammy methods. Sometimes, these banks offers you the present change price and so they don’t cost you a price to make use of their ATMs.

For further safety, use the ATM contained in the financial institution throughout enterprise hours as a result of the machines are much less prone to be tampered with and also you’re much less prone to be focused by pickpockets.

Keep away from Euronet, Eurobank, Alpha Financial institution Different Personal ATM Networks

There are a number of personal ATM networks like Euronet, Eurobank, and Alpha Financial institution that aren’t related to massive banks. These ATMs are infamous for doing sketchy issues like charging withdrawal charges and tricking you into accepting a horrible alternate price.

In reality, when you add up all these charges, it’s not unusual that you just’ll pay 15%-30% in charges.

These ATMs are far and wide and so they’re most frequently present in airports, practice stations, and vacationer hotspots to focus on individuals who don’t know any higher.

Sometimes these ATMs are freestanding models in order that’s a simple solution to inform they’re not related to a big financial institution.

By no means Select “Settle for Conversion” When Withdrawing Cash

Some ATMs (notably Euronet and the like) will ask if you wish to convert the withdrawal to your own home forex. This can be a rip-off that offers you a horrible alternate price and also you’ll sometimes pay about 10%-15% further for no motive. All the time DECLINE CONVERSION and also you’ll be charged the present alternate price.

Beware Of Extreme Withdraw Quantities

Some ATMs will default to supplying you with massive quantities of money so that you’ll need to seek for the choice to withdraw a decrease quantity. For instance, the ATM may default to €200, €300, €500, €800, and €1000 as your withdrawal choices so that you’ll need to faucet round to get a decrease quantity.

That is commonest in nations that don’t use Euros or Kilos for the reason that currencies are way more unfamiliar to guests. For instance, $100 equals 31,168.915 Hungarian Forints so it’s laborious to do the conversion in your head if you see such massive numbers. You may go to the ATM in Hungry and it asks if you wish to withdraw 150,000 Hungarian Forints and also you’d in all probability don’t know how a lot that may be in your house forex.

Why do some ATMs do that?

Foreign money conversion charges (see the earlier level).

These ATMs know some customers will “Settle for Conversion” after they withdraw money and meaning the ATM firm will pocket round 15% in charges.

Tampered ATMs

Thieves and scammers tampering with ATMs have been an issue for a very long time.

Typical scams embody putting in exterior card skimmers to card enter slot that copies card, putting in hidden cameras to document PIN codes, and typically it’s simply pickpockets ready to seize your money if you’re not trying.

So poke across the ATM earlier than utilizing it and transfer alongside if one thing doesn’t appear proper.

Do You Want To Get Euros, Kilos, And so forth. In The US Earlier than Touring?

You almost certainly don’t have to get any international forex from your own home financial institution earlier than touring to Europe as a result of any worldwide airport could have ATMs the place you possibly can withdraw money.

For those who actually wish to play it protected, purchase round $100 price of Euros, Kilos, and so forth. simply in case there’s some fluke downside with the ATMs and your bank cards don’t work if you arrive.

However you definitely don’t wish to purchase a considerable amount of international forex with you as a result of your own home financial institution will cost you a horrible alternate price + different charges and having a bunch of money isn’t very protected.

No Humorous Enterprise

The Savvy Backpacker is reader-supported. Which means if you purchase merchandise/providers via hyperlinks on the location, I could earn an affiliate fee—it doesn’t price you something further and it helps help the location.

Thanks For Studying! — James

Questions? Be taught extra about our Strict Promoting Coverage and How To Assist Us.