Funds vacationers love saving cash — myself included. However one of many bills that we shouldn’t be low-cost with is journey insurance coverage.

After over 17 years of touring the world, I nonetheless by no means go away dwelling with out it.

Why?

As a result of I’ve seen firsthand how helpful it may be — and the way a lot cash it could possibly save.

I’ve misplaced baggage, had my digital camera damaged, and even wanted emergency medical assist over time.

Journey insurance coverage has been there for me every time. Not solely has it saved me cash nevertheless it’s offered me with peace of thoughts as I discover.

I’ve written extensively over time about why you want insurance coverage, methods to choose the precise firm, and listed my most well-liked suppliers.

Immediately, I wish to discuss my favourite journey insurance coverage firm: SafetyWing.

Who’s SafetyWing?

SafetyWing is an insurance coverage firm that focuses on inexpensive protection for funds vacationers and digital nomads (although you don’t must be both to get protection). It’s run by nomads and expats who know precisely what such vacationers want.

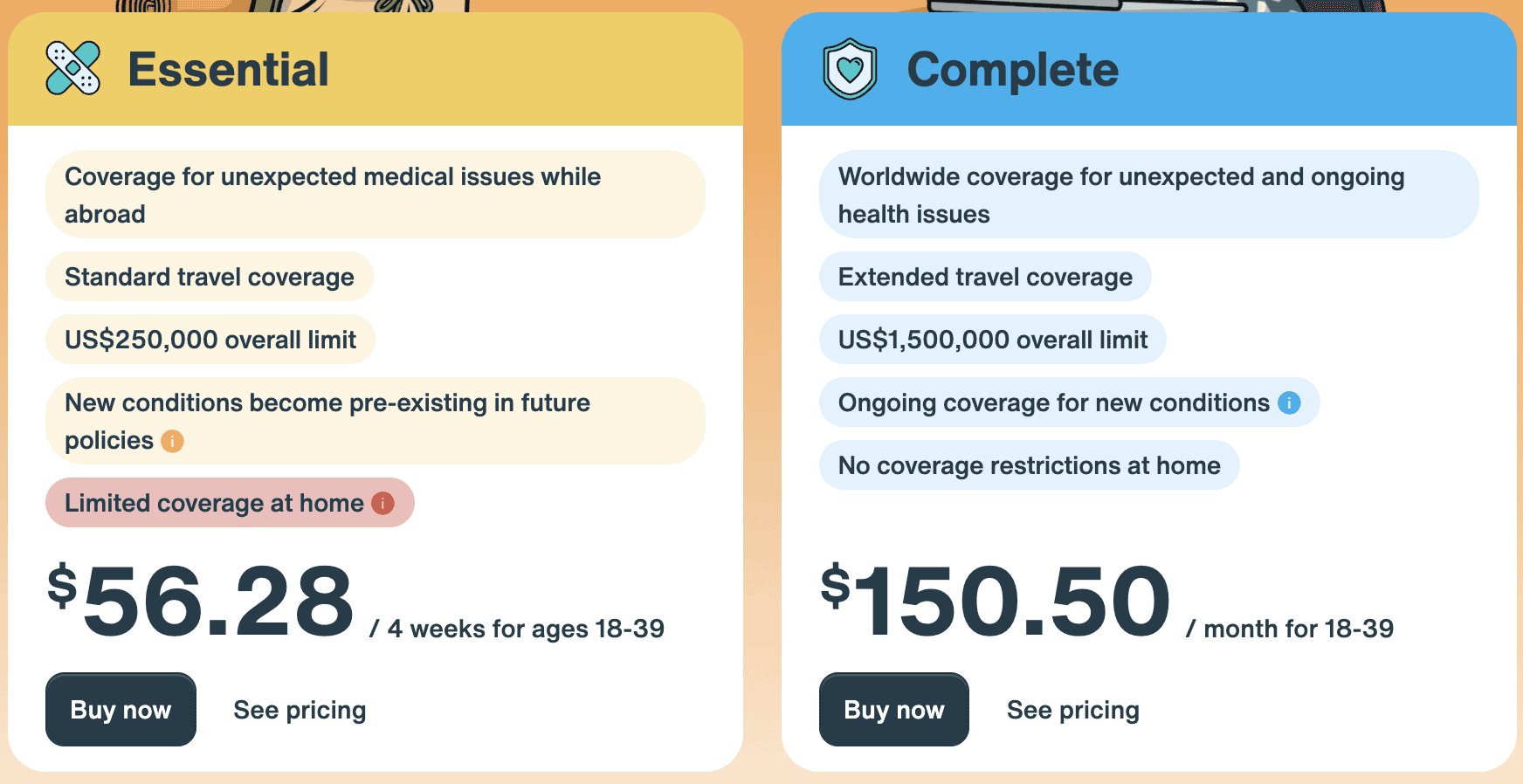

SafetyWing affords primary insurance coverage (referred to as “Nomad Important”) for a fraction of what different corporations cost, though they’re additionally much less complete. To me, they’re the most effective total journey insurance coverage firm on the market.

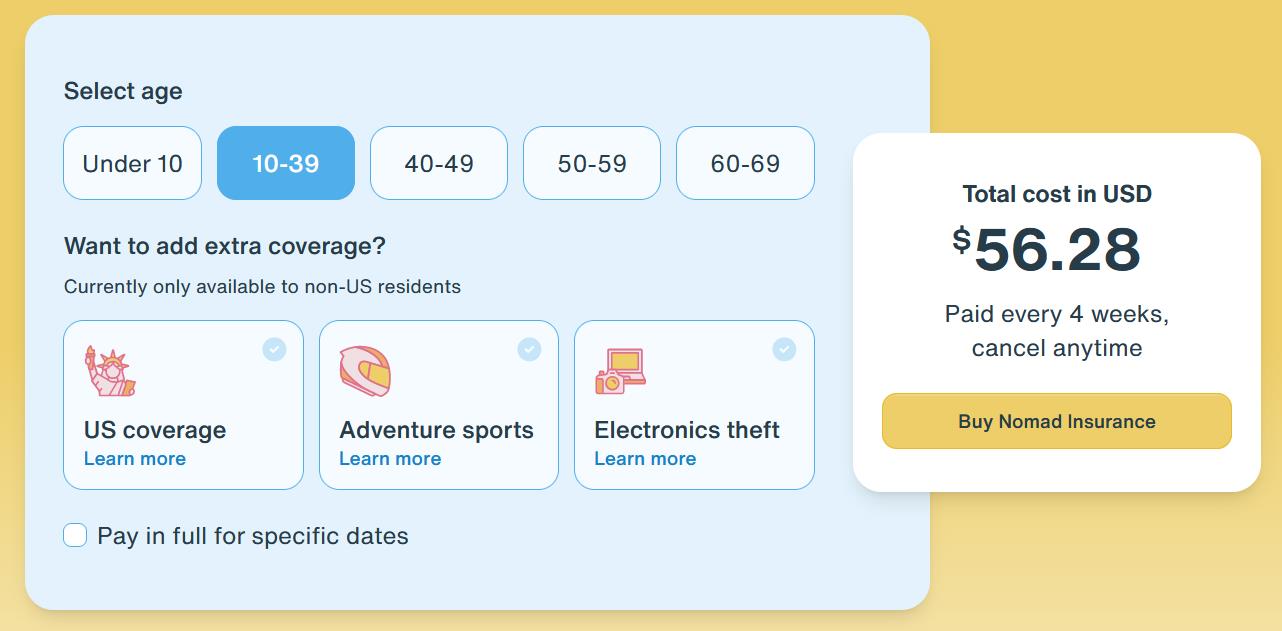

Their normal Nomad Insurance coverage protection prices simply $56.28 USD for 4 weeks (for vacationers aged 10-39). That’s one of many lowest costs on the market for dependable journey insurance coverage. They’re tremendous aggressive in terms of value.

Their protection extends all the best way to age 69, nevertheless, vacationers aged 60-69 ought to count on to pay upwards of $196 USD per 30 days for protection. Nonetheless very cheap, to be trustworthy.

However is the protection truly good? What in regards to the customer support?

Immediately I wish to evaluation Security Wing and discuss when it’s — and isn’t — price utilizing so you’ll be able to higher put together to your subsequent journey and guarantee you’ve gotten the protection you want.

What Does SafetyWing Cowl?

SafetyWing’s normal Nomad Insurance coverage plan is the Important plan. It’s simply $56.28 USD for 4 weeks of journey (exterior the US). That works out to simply $1.87 USD per day!

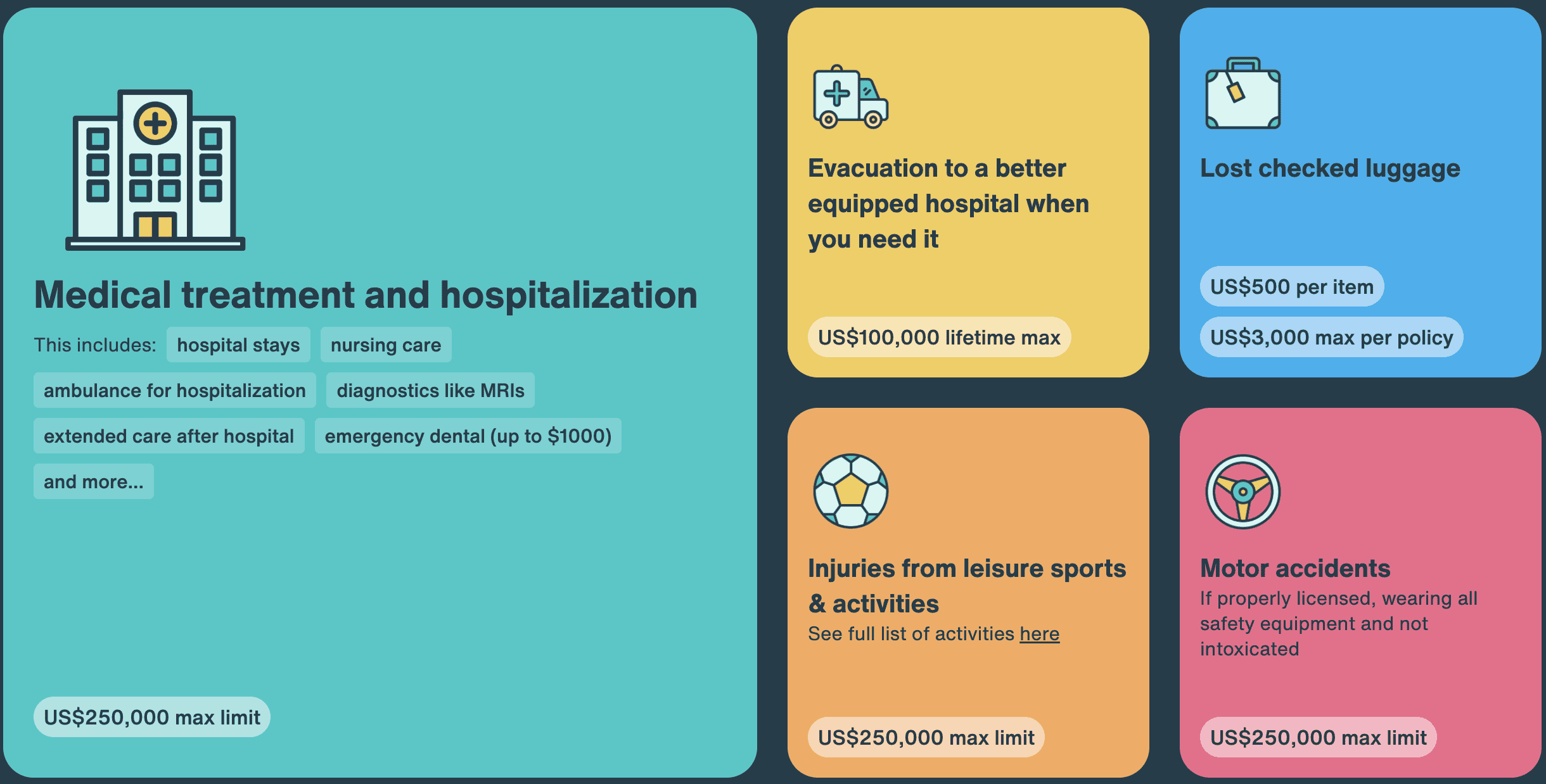

For vacationers below age 64, that plan consists of the next:

- $250,000 USD in emergency medical protection

- $1,000 USD for emergency dental care

- $100,000 USD for medical evacuation ($25,000 USD if the reason for medical evacuation is acute onset of pre-existing situation)

- $10,000 USD for an evacuation resulting from political upheaval

- $5,000 USD for a visit interruption

- As much as $100 a day after a 12-hour delay interval requiring an unplanned in a single day keep. Topic to a most of two days.

- $12,500–25,000 USD for dying or dismemberment

- $20,000 USD for repatriation of stays

Make sure you test the outline of protection for any circumstances that apply.

Its $100,000 USD for medical evacuation is on the low finish, however except you’re heading out into the distant wilderness, that must be positive. (In order for you greater protection, get MedJet.)

Its travel-delay payout is fairly low, however airways and most journey bank cards present journey delay help too so that you won’t even want the protection provided by SafetyWing. Moreover, it doesn’t actually cowl costly electronics, which sucks when you have a dear digital camera or video gear.

As with most traditional journey insurance coverage, this one doesn’t embrace pre-existing circumstances or sure journey sports activities, so it’s not a superb coverage should you’re going to do lots of journey actions on the street.

They do supply a pair useful add-ons that I believe lots of vacationers will admire, together with protection for journey actions and electronics theft. That signifies that should you want the protection, you’ll be able to pay additional for it. Nevertheless, should you don’t want it you then don’t must pay for it, maintaining your prices low. I admire that, as somebody who all the time wants digital protection however who by no means wants journey exercise protection (I’m not a giant adrenaline junkie).

What’s Not Lined?

The Important plan is primarily geared in the direction of masking medical emergencies and primary journey mishaps (like delays and misplaced baggage). Listed below are some issues that aren’t lined:

- Alcohol- or drug-related incidents.

- Excessive sports activities & journey actions (except you buy the journey sports activities add-on, which is out there for non-US residents)

- Pre-existing circumstances or normal check-ups

- Journey cancellation

- Misplaced or stolen money

Nomad Full: Protection for Digital Nomads and Lengthy-Time period Vacationers

In 2023, SafetyWing launched Nomad Well being (now referred to as their “Full” plan). It’s insurance coverage for digital nomads, distant employees, and long-term vacationers. This new plan affords a mixture of the usual emergency protection that we’ve been discussing above together with “common” well being care protection, corresponding to routine visits and preventive care.

The Full plan additionally affords protection in 175 international locations, consists of wellness advantages, psychological well being care, and the power for people to decide on their very own physician whereas touring. They are going to be increasing protection too, together with an add-on for “electronics theft” (which, as somebody who has been robbed whereas touring, I believe is a good concept).

It’s just like the type of medical insurance you’d discover in your house nation, guaranteeing that you simply’re sorted it doesn’t matter what occurs when you’re overseas.

You’ll be able to be taught extra and examine the plans right here.

When you’re simply heading out for a pair weeks or a pair months, SafetyWing’s Important plan is the choice for you. It’s good for emergencies, is tremendous inexpensive, and is designed for funds vacationers. It’s the plan I take advantage of after I journey as of late.

Nevertheless, should you’re going to be working overseas or touring for months (or years), then their new Full plan is the higher possibility. It affords rather more protection whereas nonetheless being inexpensive. In reality, it’s the plan I want I had after I began touring long-term!

You’ll be able to be taught extra in regards to the Full plan in my devoted evaluation.

Making a Declare

SafetyWing makes it straightforward to file a declare by way of their on-line portal. You simply add all of the required paperwork, screenshots, and photographs, and wait to listen to again. Whereas claims can take as much as 45 enterprise days, most are dealt with in lower than every week (as of writing, the typical wait time is 4 days).

When you learn the critiques on-line, most individuals who had a damaging expertise both didn’t know in regards to the deductible (SafetyWing eliminated their deductible for non-US residents as of 2024) or hated the size of time it took to receives a commission. However that’s fairly regular for folks to complain about.

On the plus aspect, SafetyWing’s common time to deal with a declare is down to simply 4 days. That’s manner quicker than most corporations!

A Word About COVID

SafetyWing does embrace protection for COVID-19. So long as the virus was not contracted earlier than your plan begins, then it is going to be lined (so long as it’s medically mandatory).

SafetyWing additionally covers quarantine prices (exterior your house nation) for as much as $50 USD/day for 10 days (offered that you simply’ve had your plan for no less than 28 days).

Execs and Cons of SafetyWing

Right here’s a glance that the professionals and cons of SafetyWing at a look that can assist you resolve if it’s the most effective insurance coverage supplier for you and your journey:

Most inexpensive journey insurance coverage on the market

Solely covers as much as age 69

Presents protection for COVID-19

Restricted protection for gear/electronics

You should purchase plans on-line even should you’re already

in your journey

Restricted protection for journey actions

Straightforward to submit claims on-line

No journey cancellation protection

After being overseas for 90 days, you retain your

medical protection for 30 days in your house

nation (15 days should you’re from the U.S.)

As much as 2 youngsters below 10 per household

(1 per grownup) might be included without cost

No have to set an finish date (subscription

renews each 4 weeks)

Two completely different plans imply you’ll be able to simply discover one which works for you/your funds

Who’s SafetyWing Good — and Not Good For?

SafetyWing is designed as primarily medical protection. Since SafetyWing is designed for the budget-conscious digital nomad, it doesn’t cowl some areas that may be extra of a precedence for a shorter-term traveler. Right here’s a fast chart that can assist you resolve if SafetyWing is best for you:

Funds vacationers

Individuals touring with a TON of electronics

Somebody in search of easy emergency protection

Anybody needing complete journey delay

or cancellation

Individuals with out numerous costly electronics

Individuals doing extreme excessive sports activities/actions

Digital nomads who want medical protection

for long-term journey

Journey insurance coverage is one thing I by no means go away dwelling with out. I do know it’s a boring subject to examine and analysis, however it could possibly actually prevent a whole bunch or hundreds of {dollars} in payments! I by no means, ever go away dwelling with out it. You shouldn’t both.

So, the following time you’re on the street, think about SafetyWing. To me, they’re the most effective journey insurance coverage firm on the market for funds vacationers.

You should use the reserving widget beneath to get a quote (it’s free):

Guide Your Journey: Logistical Suggestions and Methods

Guide Your Flight

Discover a low-cost flight through the use of Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you all the time know no stone is being left unturned.

Guide Your Lodging

You’ll be able to guide your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Reserving.com because it persistently returns the most cost effective charges for guesthouses and accommodations.

Don’t Neglect Journey Insurance coverage

Journey insurance coverage will shield you in opposition to sickness, damage, theft, and cancellations. It’s complete safety in case something goes improper. I by no means go on a visit with out it as I’ve had to make use of it many instances prior to now. My favourite corporations that provide the most effective service and worth are:

Need to Journey for Free?

Journey bank cards can help you earn factors that may be redeemed without cost flights and lodging — all with none additional spending. Take a look at my information to selecting the correct card and my present favorites to get began and see the newest greatest offers.

Want a Rental Automobile?

Uncover Automobiles is a budget-friendly worldwide automobile rental web site. Regardless of the place you’re headed, they’ll have the ability to discover the most effective — and least expensive — rental to your journey!

Want Assist Discovering Actions for Your Journey?

Get Your Information is a large on-line market the place yow will discover cool strolling excursions, enjoyable excursions, skip-the-line tickets, non-public guides, and extra.

Able to Guide Your Journey?

Take a look at my useful resource web page for the most effective corporations to make use of while you journey. I checklist all those I take advantage of after I journey. They’re the most effective in school and you’ll’t go improper utilizing them in your journey.