Holidays are practically approaching! Whereas it’s certainly essentially the most fantastic time of the 12 months, it is usually the most costly season of all. There are simply too many issues to not be missed or skipped in your price range checklist for holidays. For many people, it has develop into a practice to have a good time each Christmas and New 12 months within the grandest approach doable. It’s certainly a practice that shall be handed on and embraced by our future technology. Whereas this celebration will stay the identical for a lot of succeeding years (or most likely centuries), the yearly price range is consistently altering.

The current financial turndown resulted in a worsening case of inflation. It signifies that the costs out there are drastically growing. Other than the seemingly uncontrollable inflation, the availability and demand through the Vacation season are undeniably excessive, ensuing to much more costly charges for items and providers. For somebody who’s all the time on a decent price range like me, this shall be a tricky problem. Dealing with my year-end price range is sort of tough but manageable. All it takes is correct and well timed planning that can assist you get via all these budget-shattering Vacation celebrations. You may also make the most of the usage of on-line calculators that can assist you out together with your price range digitally. Listed beneath are a number of the suggestions and tips that you are able to do to outlive this season.

Set a Price range and Persist with It

Set a Price range and Persist with It

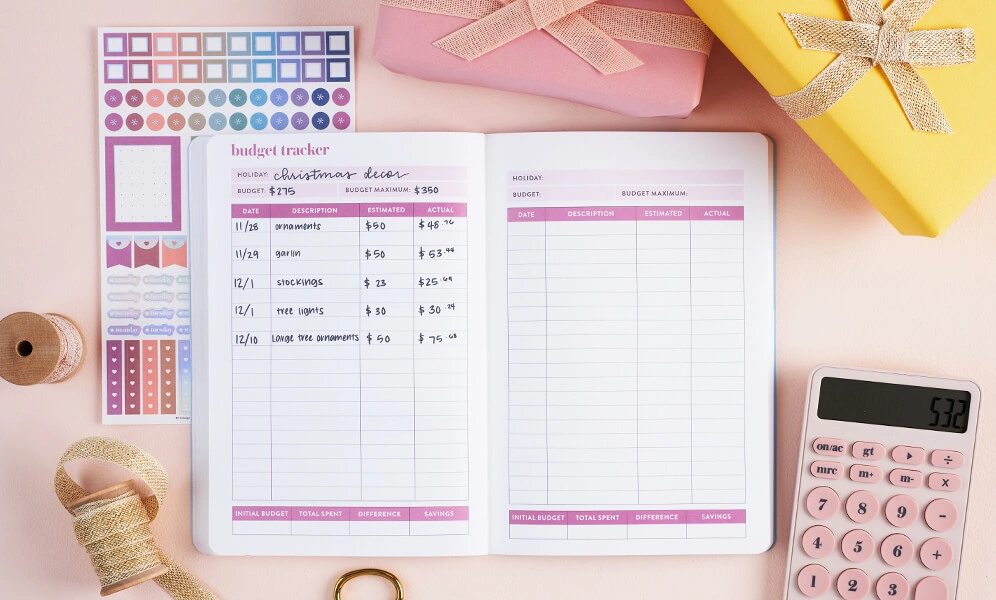

Vacation purchasing could be very aggravating, particularly if issues don’t go as deliberate. With out setting a price range for vacation, there shall be an excellent probability to overspend which is able to solely smash your financial savings for the following month or so. To stop your self from overspending, you will need to set a really strict price range for the vacations. It’s best to know the place precisely your cash will go. To take action, checklist down all the products and providers that that you must buy these coming holidays, test for his or her market costs, and canvass for the bottom charges to avoid wasting more cash.

With all of the promos, gross sales, and restricted gives for holidays, it is usually straightforward to be tempted. You may contemplate shopping for these things despite the fact that they don’t seem to be a part of your vacation purchasing checklist. Simply since you had been in a position to purchase these things at discounted charges doesn’t imply you saved cash from it. Setting a price range shouldn’t be sufficient, it’s important to persist with it. Additionally, ensure that to set rooms for worth changes and lend additional financial savings for sudden worth modifications.

Seek for Higher Offers and Reductions

A couple of of one of the best issues concerning the Vacation season are the limited-time promos and gross sales provided by totally different manufacturers. Most of those promos will final for a month or two and it’s one thing you should benefit from. Seize the chance to buy the merchandise throughout their promo interval to avoid wasting more cash. Once more, simply make it possible for these things are a part of your allotted price range. There are lots of on-line and eCommerce platforms right this moment that provide beneficiant reductions and different thrilling offers.

A few of these provide “free delivery” offers which can also be a good way to avoid wasting more cash. These free delivery vouchers are extra helpful if you happen to order the merchandise in bulk. Some platforms additionally provide money again which lets you earn extra cash for every merchandise you purchase from their store. You may also do it the outdated approach by gathering coupons and printed vouchers for added reductions.

Take Benefit of your Credit score Card Perks

When doing all of your vacation spending, it’s perfect to make use of your bank cards moderately than paying them in money or utilizing your debit card. Whether or not you’re planning a week-long journey otherwise you need to spend cash shopping for the proper present on your pals and family members, there are good causes to make use of your playing cards as a type of cost. You’ll be able to benefit from the rewards you could get from utilizing your card on your vacation spending. The extra you buy, the extra factors you’ll be able to earn. These factors could be transformed into varied types of rewards together with money again, freebies, and plenty of different perks. You may also benefit from some playing cards that permit objects to be paid in 12 or 24-month installments with a 0% rate of interest. To high all of it off, utilizing bank cards regularly and paying your payments on time will successfully enhance your credit score rating. A wonderful credit score rating lets you apply for loans and be accepted rapidly.

Handle Your Price range with On-line Calculators

To remain trustworthy to your price range and to stop your self from overspending, you’ll be able to benefit from these freely accessible on-line monetary calculators. Utilizing these on-line instruments, you’ll be able to handle all of your bank card funds and be sure that your month-to-month bank card payments shall be paid on time. In case you are making use of for a mortgage in preparation for the vacations, you can even use these monetary calculators that can assist you estimate the potential month-to-month, bi-weekly, or weekly funds, and to find out whether or not or not it suits your price range.

There are additionally web sites that provide a variety of different monetary calculation providers. I not too long ago got here throughout calculator.me which gives a large number of on-line instruments that permit you to simply calculate mortgage and bank card funds. It additionally gives calculators which are particularly programmed for auto loans and mortgages. There’s additionally a Financial savings calculator that helps you calculate the long run worth of a month-to-month funding in addition to a Price range Planning Calculator that can assist you handle your month-to-month or vacation bills.

Don’t Neglect Your Common Bills

Additionally it is vital to recollect that apart from your vacation bills, you even have common and month-to-month bills to pay. These embrace your month-to-month electrical energy payments, web service, telephone and water consumption payments, and plenty of different common bills that shouldn’t be neglected. To not point out the cash that that you must lend for meals and day by day allowances. Not like your vacation spending, these payments usually tend to be thought of a high precedence. It’s important to not miss them, in any other case, you may end up in monetary misery.

Whereas all of us need to have a good time holidays as extravagantly as doable, you will need to do not forget that we must always not spend greater than what we earn or what we will afford. Price range your cash correctly and ensure to go away room for financial savings.