Shopping for an RV is a crucial if not daunting monetary choice. It’s a major buy in value alone. After which it’s a must to contemplate the life-style prices, together with all the things from gas to RV-specific insurance coverage to upkeep to low season storage. The important thing to a financially profitable RV way of life is an in-depth information of what issues price, what you’ll be able to afford, and what steps you’ll be able to take to price range. And that’s very true in relation to financing the acquisition of an RV — essentially the most vital price of the life-style.

The expertise of shopping for an RV falls someplace between shopping for an vehicle and shopping for a home (appropriately). It’s a major funding due to the sheer greenback quantity and due to its long-term worth. What you pay now might be related in ten or twenty years if you find yourself both nonetheless paying off a mortgage, promoting the RV, or buying and selling it in. However pay the mistaken value or get the mistaken financing time period and it might have an effect on you later.

You may safe good financing phrases now that might be of appreciable profit additional down the street. There are issues you’ll be able to management to impression your phrases. Right here, we’ll cowl elements like down fee quantity, credit score rating, mortgage kind, and financing choices — all of which play an necessary position in figuring out what you’ll pay total for the RV portion of the RV way of life.

Daunting? Nah. Empowering. The extra you realize, the higher outfitted you’ll be on the dealership to search out the RV that makes essentially the most sense together with your price range and to safe phrases you perceive and are able to sustaining.

Consider your price range and credit score rating

Courtesy of Tenting World

So what’s within the cookie jar? The 2 most typical roadblocks that happen when financing an RV are overestimating your monetary functionality and underestimating it. We simplify the method an excessive amount of: can I make that month-to-month fee? Positive. Or, conversely: Can I afford a $35,000 trailer? Heck no.

Sure, month-to-month fee and total price are two of essentially the most vital elements. However there’s additionally a down fee, time period size, and rates of interest. Collateral and worth depreciation. Every of those will come into play and can change your outlook. For now, an sincere analysis of your price range will prioritize your monetary well being first, and proudly owning an RV second.

By looking at your funds, it is best to have the ability to decide the 2 most necessary items of knowledge you’ll have to finance your RV:

- how a lot you’ll be able to afford to place right into a down fee

- how a lot you’ll be able to afford to pay every month in your mortgage

Get particular. We suggest making use of apps that may allow you to determine what you spend and what you save, month to month. Empower Private Wealth and Goodbudget observe what you spend and what you can spend that will help you decide your month-to-month allowance to place in direction of one thing like an RV.

It may be particularly difficult to find out the down fee quantity you place down. Monetary advisors suggest we put aside and hold about six months’ price of security spending within the financial institution within the case of an emergency. Frequent sense tells us we must always put aside extra. And someplace in there may be the downpayment quantity we really feel comfy placing in direction of an RV buy.

Lenders use your credit score rating as a main think about figuring out your eligibility and creditworthiness, which is able to decide your rate of interest and mortgage approval. You should use apps like Credit score Karma to test your credit score rating (with out penalty), and it’ll additionally present updates to modifications in your credit score rating.

What determines your credit score rating? Right here’s a easy breakdown of the elements and their weight in your credit score rating.

- Cost historical past (35%) – What has been your observe file of paying your payments on time?

- Excellent debt (35%) – An summary of what you owe in direction of different loans or penalties.

- Size of credit score historical past (15%) – Your expertise as a borrower (how lengthy and the way dependable).

- New credit score (15%) – How a lot have you ever just lately opened in new credit score strains?

These elements will every contribute to your total credit score rating, which is a system that ranks you between 300 and 850 factors, which is a measure of your creditworthiness. Banks wish to know they will belief you to make good in your mortgage, and that is the system they use. Under is a breakdown of credit score rating rankings.

- Distinctive: 800 to 850

- Very Good: 740 to 799

- Good: 670 to 739

- Truthful: 580 to 669

- Very Poor: 300 to 579

Most RV lenders favor a rating that’s at or above 700. However in case you are decrease than this, don’t depend your self out. Some lenders will approve a rating as little as 650, however at a better rate of interest. And that is the catch: Your mortgage approval doesn’t essentially guarantee your mortgage high quality. You would possibly get accepted for a mortgage, however at what price? A high-interest charge, extra of a down fee required, for a long run, and, inevitably, a better total price.

The extra of a danger you might be to a lender, the extra necessities they’ll have.

The chance to the lender will decide your mortgage phrases

Earlier than we speak concerning the various kinds of loans and financing obtainable, it’s useful to grasp the explanation why some lenders would require increased rates of interest, totally different mortgage phrases, or totally different types of collateral.

The golden rule of lending: The lender needs to enter loans with confidence that the lendee can pay again the mortgage. In any other case, the lender is in danger. In order you study concerning the financing course of for RVs, at all times fall again on the truth that lenders need safety of their loans. This manifests in a few alternative ways:

Rate of interest

The much less seemingly a financial institution believes you might be to repay your mortgage in full, the upper it is going to make your rate of interest. That means, the financial institution rapidly begins to earn again the mortgage. In case your credit score rating is low, the financial institution would possibly see this as an elevated danger and can improve your rate of interest.

Time period size

The longer the period of time you require to repay the mortgage, the longer the financial institution is in danger. Plus, the financial institution might imagine you might be much less able to paying off your mortgage should you want a long run size.

Debt to earnings ratio

That is your month-to-month debt funds divided by your gross month-to-month earnings. The extra you stretch your borrowing capability, the extra suspicious a possible lender could also be. If contemplating an RV, take inventory of your DTI and contemplate paying off a major mortgage previous to making use of.

Down fee

The larger your down fee, the much less danger to the lender. Frequent sense tells the lender that should you can accumulate a major down fee (and borrow much less), the extra seemingly you might be to repay your full mortgage.

Collateral

Many loans require some type of collateral or a type of further safety. Requiring a cosigner is an efficient instance of extra safety, and this gives further assurance to the lender that they may recoup their mortgage quantity.

For secured loans (extra on these later), the RV itself is the collateral, that means the lender can repossess the mortgage in case you are unable to make funds. We point out this as a result of lenders usually wish to enter a mortgage the place the worth of the RV holds. That is why it’s generally simpler to achieve approval for a mortgage for a brand new or newer mannequin when financing an RV.

These are the first elements that decide the chance to the lender and due to this fact decide your mortgage phrases. When serious about the mortgage relationship, contemplate these two major classes: the chance to the lender and your creditworthiness.

Sorts of RV Loans

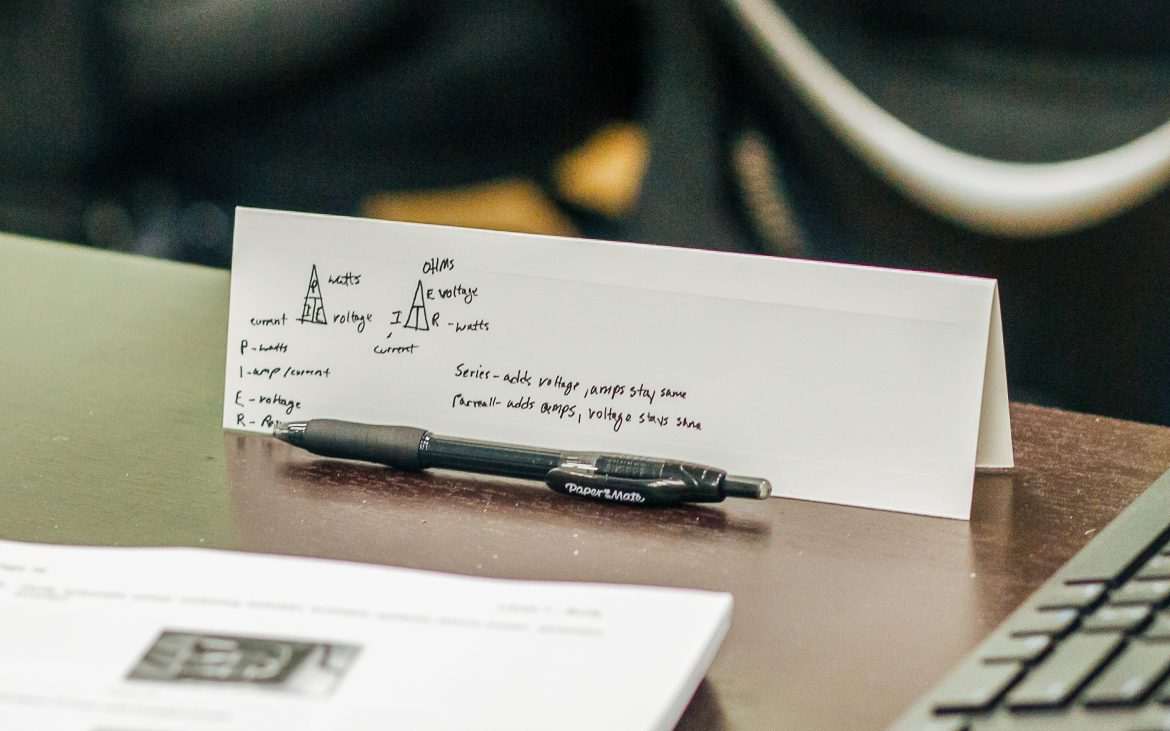

Courtesy of Tenting World

Not all RV loans are the identical. In actual fact, there are three main mortgage sorts: secured, unsecured, and peer-to-peer. (Not too long ago, a fourth mortgage class has grow to be obtainable for peer-to-peer fleet house owners who run rental companies, however we received’t cowl that right here).

These various kinds of loans nonetheless fall again on those self same elements basic to a lender/lendee relationship: danger and creditworthiness. However they function in several preparations concerning rate of interest, time period size, collateral, and eligibility.

Secured mortgage

A secured mortgage signifies that the mortgage quantity is backed up — or “secured” — with some type of collateral. RVs are an enormous funding. For secured RV loans, the RV itself acts because the collateral on the mortgage. This alleviates danger to the lender as a result of, must you cease paying, they will repossess the RV and recoup their risked worth.

Secured loans typically apply to RVs lower than fifteen years previous. (When the RV is the collateral, it must have foreseeable resale worth).

Secured loans usually require a bigger down fee, too. This serves as extra safety for a bigger mortgage. In any case, loads as at stake for the lender with an RV of serious worth. The upside, although, is that, with a bigger down fee and with the RV serving as collateral, you’ll be able to anticipate a aggressive rate of interest in your low, even for a long run.

Unsecured mortgage

Unsecured loans require no collateral. They act as private loans and can be utilized when financing an RV. So what’s the catch? Nicely, unsecured loans have some necessary distinctions from secured loans. Most significantly, unsecured loans are normally decrease in greenback quantity than secured loans. Patrons usually use an unsecured mortgage for used RVs, low-cost RVs, high-mileage RVs, or as a mortgage versatile sufficient for use to pay for auxiliary RV-related bills.

As a result of unsecured loans are technically riskier for lenders, they will require a better rate of interest, extra of a down fee, and so they’re pickier about who they lend to. For unsecured loans, you have to have an excellent credit score rating and a low debt-to-income ratio to qualify.

Take into account that level concerning the rate of interest. And do not forget that qualifying for a mortgage doesn’t imply the mortgage is a wholesome monetary choice. Unsecured loans can go as excessive as 36% rate of interest, and, at that time, it’s not prone to be a wise funding.

Peer-to-peer loans

Subsequent up are peer-to-peer loans. So, secured loans and unsecured loans require you to work with a lender to scale back their danger sufficient that they’re prepared to approve you for a mortgage. With these mortgage sorts, it may be exhausting to qualify with poor credit score or a minimal down fee. Lenders in these conventional loans are sometimes banks, dealerships, or credit score unions — and so they every have pretty strict insurance policies on how far they will bend the yardstick to make a mortgage.

However what should you discovered a non-public lender prepared to take a chance with extra danger? Enter the peer-to-peer mortgage.

Peer-to-peer loans are pretty new. They permit two people to bypass the normal financial institution or credit score union mannequin and lend straight by using a web-based lending platform. In these conditions, they will attain an settlement on any phrases they like, which generally permits for debtors to qualify when banks or credit score unions had rejected them.

The drawbacks? There’s extra danger to the borrower and the lender. For the borrower, there may be much less safety for them in the event that they fail to make a fee, and their debt can rapidly be handed on to a collections company. They could additionally see increased charges by the platform.

For the lender, you might be generally coping with a borrower who’s unable to safe lending from a financial institution or credit score union — and there’s usually an excellent purpose for that.

RV kind

Typically, smaller RVs like campers, journey trailers, and pop-ups will use an unsecured mortgage as a result of they’re decrease in worth. The identical is true with used RVs. Chances are you’ll incur a better rate of interest for older and smaller RV loans, which makes it necessary to entrance as a lot as doable on the down fee.

Secured loans usually apply to RV fashions of 15 or fewer years and below 100,000 miles.

Additionally, in case you are contemplating buying a number of RVs to make use of for industrial use — corresponding to operating an RV rental firm — new and upcoming loans will make it simpler for these debtors to get approval for increased greenback, secured loans.

Alternate financing

You might also wish to contemplate extra financing choices. Usually, you’d orchestrate your mortgage by a standard lender like a financial institution or a credit score union. In these circumstances, you could possibly prequalify for a mortgage, and we are going to cowl pre-approval later on this article. However dealership financing can also be a route you’ll be able to take, however contemplate a few of the elements concerned.

Many dealerships supply financing choices, and these could appear particularly handy to finish all paperwork by one group, from begin to end. However know that comfort will typically come on the value of a better rate of interest and potential related charges. Put together to have a response for such incentives as prolonged warranties, money again, or reductions.

As we talked about earlier, an RV mortgage falls someplace between an auto mortgage and a mortgage. So it makes a little bit of sense that some RV consumers select to make use of their dwelling fairness to finance an RV. These really might have a decrease rate of interest, nevertheless it’s at all times an added danger to make use of your own home in a purchase order settlement, and also you successfully put your own home in danger when utilizing it as collateral.

What’s an RV price?

We’ve offered lots of details about qualifying for an RV mortgage. Step one, decide your price range. The second step, get certified. However we’ve but to debate how a lot of a mortgage it is best to take out for a given RV. And that call must transcend what’s enticing and what you’ll be able to afford.

How have you learnt you’re paying the correct amount for an RV? With out a clear understanding of how pricing works, you would be in danger and on the mercy of what a dealership tells you.

Contemplate the trade when financing an RV. As with vehicles, the RV trade operates a lot, if no more, primarily based on provide and demand. For instance, 2021 noticed a skyrocket in RV gross sales throughout the nation as extra new campers took to the outside within the face of a pandemic. RV costs elevated. It grew to become harder to search out an RV. Costs have since balanced, nevertheless it was a manifest instance of that offer and demand relationship when it got here to RVs.

Prior to buying an RV, be sure you’ve researched the mannequin, trade developments, producer, and seller. Every of those would possibly have an effect on the present charge of the RV. The next value won’t be a mistake if the demand for a sure kind of RV or mannequin is excessive, for instance.

Shopping for used

The used market is an more and more main participant within the RV trade — particularly after so many new RVers got here into the market throughout the pandemic. Don’t rule out buying a used RV in case you are available in the market. In actual fact, you could possibly afford a bigger or extra sturdy RV should you purchase used. The secret’s to find out the correct worth of the RV.

When procuring used, know that this may increasingly change the financing course of, and chances are you’ll even must resort to an unsecured mortgage with a better rate of interest and even discover a peer-to-peer charge on a web-based platform. To guard your self farther from doable overpricing, use instruments just like the Good Sam RV Valuator to find out the proper worth of an RV.

Additionally, analysis the RV’s historical past earlier than buying, together with any accidents or main repairs. Use sources like Carfax or the Nationwide Motor Automobile Title Data System to search out any doable incidents that will have an effect on the value of the RV. Additionally, decide from the vendor if the RV comes with any prolonged warranties, prolonged service plans, or notable accent values.

Nuts and bolts

Courtesy of Tenting World

So what steps are concerned if you’re able to finance an RV? Right here we break down the nuts and bolts required to finance an RV.

Get pre-approval for a mortgage (non-compulsory)

Mortgage pre-approval helps you price range and decide the small print of your mortgage earlier than you ever select an RV to finance. That is particularly useful, strolling into the dealership with a set quantity you might be accepted for. This reduces the chance of creating poor financing selections primarily based on a particular RV or dealership supply.

Negotiate the RV value

If you happen to’ve finished your analysis, it is best to have an excellent understanding of what the kind of RV — together with make, mannequin, 12 months — ought to run. Clearly, you’ll nonetheless want to barter a value with the vendor or seller, however having a ballpark determine can go a good distance. And, as at all times, be able to stroll away from the deal if it’s not inside your pre-approval or your pre-determined price range.

Decide down fee, time period size

If you happen to’ve taken inventory of your funds and your price range, it is best to have already got a down fee in thoughts in relation to financing a particular RV. The one factor that will have an effect on that quantity would be the time period size and provided rate of interest.

Evaluate mortgage settlement, follow-through

If you happen to’re not sure about any phrases, charges, charges, or month-to-month expectations, now’s the time to take the time earlier than signing any paperwork to know for sure the settlement you’re selecting. You need to have a crystal clear understanding of what the overall price might be, together with your month-to-month funds, rate of interest, extra charges, and the overall price over the time period of the mortgage, which might stretch so far as thirty years.

Financing an RV isn’t out of anybody’s wheelhouse, they only should be ready to have the persistence and dedication to understanding the steps concerned, the potential danger, and the expectations. To study extra concerning the financing an RV, the Good Sam Finance Middle is your useful resource when contemplating financing an RV. With such instruments because the RV mortgage calculator and a complete FAQ part that solutions debtors’ most necessary questions, you get the information you have to take advantage of accountable, cost-effective selections in relation to financing your RV.