Every year, HVS researches and compiles growth prices from our database of precise resort building budgets. This supply offers the premise for our illustrated whole growth prices per room/per product kind.

INTRODUCTION

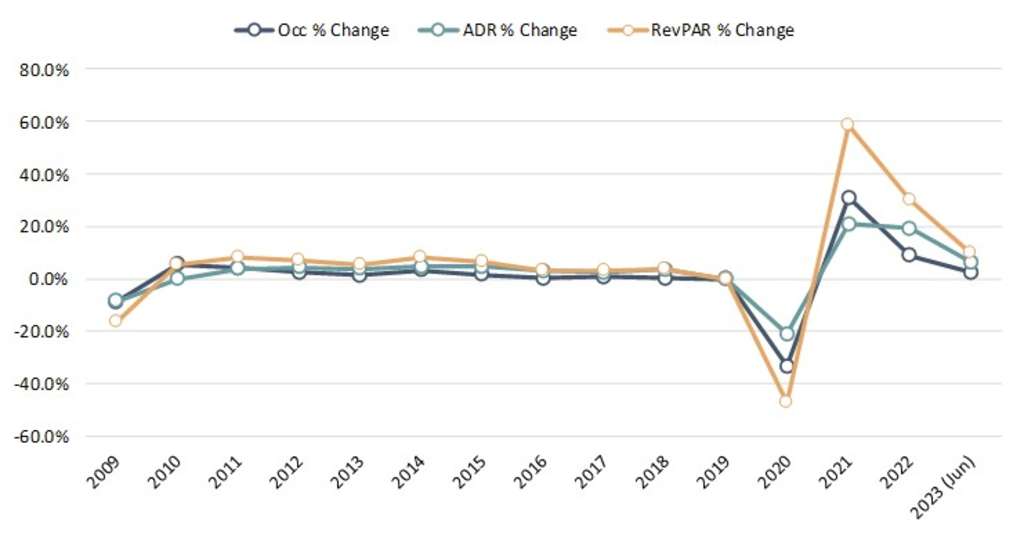

After reaching an all-time low in 2020, attributed to the influence of the COVID-19 pandemic, the nationwide lodging market shortly rebounded to an all-time income per accessible room (RevPAR) excessive in 2022. Whereas occupancy ranges in 2022 remained under 2019 ranges, ADR exceeded 2019 ranges that 12 months, propelled by a mix of inflation and a surge of leisure journey within the post-COVID-19 period. Knowledge for 2023 illustrate that the impacts of COVID-19 are usually behind us and the lodging market has reached a brand new stage of stabilization, with occupancy progress persevering with, albeit at a extra muted tempo, and ADR additionally illustrating additional progress.

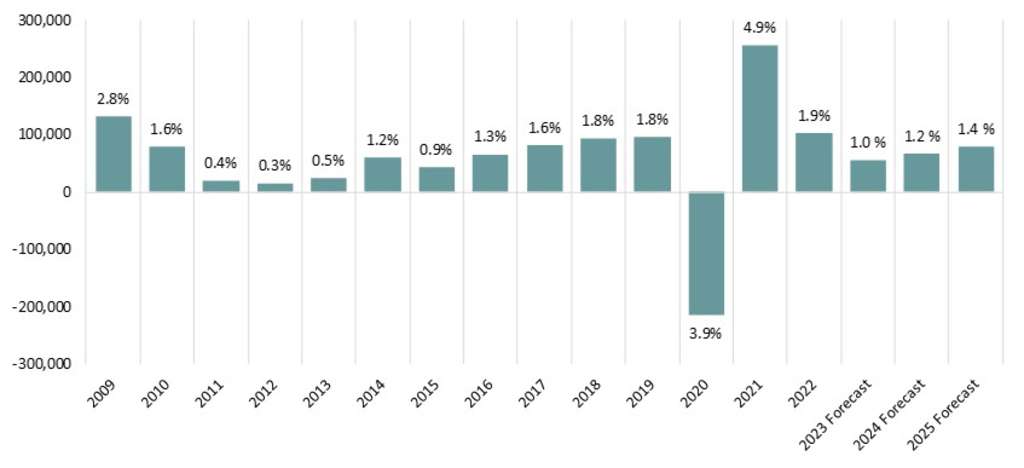

COVID-19 had a big influence on resort provide and building prices. In 2020/21, except for tasks already beneath building, new resort growth nearly got here to a standstill because of uncertainty relating to the restoration in financial situations. For the primary time ever, resort provide in 2020 was reported to have decreased dramatically because of the momentary closure of many lodges. The following reopenings of those lodges in late 2020 and all through 2021 resulted in an outsized enhance in provide in 2021. Whereas a small portion of these provide additions had been newly constructed properties, the overwhelming majority had been reopenings of present lodges. Provide progress normalized in 2022 however is forecast to be minimal from 2023 by 2025 given the rise in building prices and different growth challenges, as described in additional element on this report.

HVS has tracked resort growth prices for over three a long time, gathering knowledge from precise resort value budgets throughout our assignments. This 2023 survey studies per-room resort growth prices based mostly on knowledge compiled by HVS from resort tasks proposed or beneath building in the course of the 2021 by 2022 calendar years. The info replicate eight product classes: limited-service, midscale extended-stay, upscale extended-stay, dual-branded, select-service, full-service, and luxurious lodges, in addition to redevelopment tasks. Provided that this survey offers a retrospective view, lingering provide chain points and inflationary elements in 2023 is probably not totally mirrored within the knowledge.

The HVS U.S. Resort Improvement Value Survey units forth averages of growth prices in every outlined lodging product class. The survey shouldn’t be meant to be a comparative device to calculate adjustments from year-to-year, however relatively, it displays the precise value of constructing lodges throughout america in 2021 and 2022. As shall be mentioned, the medians and averages set forth on this survey are drastically affected by the categories and places of lodges being developed at this level within the growth cycle. Our purpose in sharing this publication is to offer a foundation for builders, buyers, consultants, and different market members to guage resort growth tasks. Provided that growth prices for lodges are depending on a large number of things distinctive to every growth and placement, this report shouldn’t be relied upon to find out the price for precise resort tasks or for valuation functions. Quite, it’s supposed to offer help for preliminary value estimates, in addition to to point out a comparability throughout the varied resort classes.

SUPPLY-AND-DEMAND DYNAMICS AFFECTING HOTEL DEVELOPMENT

The 12 months 2022 served as one other interval of restoration and progress for resort occupancy and common every day price (ADR). STR reported nationwide year-end 2022 occupancy and ADR at 62.7% and $148.83, respectively. Within the year-to-date interval by June 2023, the metrics had been reported at 62.9% and $154.45, respectively. This equates to a respective 2.3% and 6.2% enhance in occupancy and ADR when in comparison with the identical interval of 2022. For this 2023 year-to-date interval, RevPAR is up 8.7% when in comparison with 2022, illustrating the resilience and restoration of resort efficiency within the post-COVID-19 period.

— Supply: HVS

The pandemic affected completely different markets in varied methods. Main markets, which symbolize the highest 25 cities in america, skilled the steepest drops in RevPAR for 2020 in comparison with 2019, down 58% on common by year-end. In distinction, RevPAR declined 40% in all different markets throughout the identical interval. This comes as no shock, as city locations had been most affected by the pandemic given their greater reliance on enterprise, group, and worldwide journey.

Equally, due to this extra pronounced influence on city locations, the change in provide in 2020 in main markets was -8.4%, in comparison with -1.4% in secondary markets, as some lodges needed to quickly droop operations. Nonetheless, essentially the most noticeable change in provide occurred post-pandemic. Provide in main markets grew by 8.3% in 2021 and 4.4% in 2022. In distinction, the change in provide in all different markets was 3.7% in 2021 and 0.7% in 2022. These knowledge present that regardless of vital interruptions in 2020, new provide has continued to enter main and concrete markets at a better price than all different markets. That is possible as a result of most resort growth tasks that opened in 2021 and 2022 had been deliberate in or previous to 2019/20.

Going ahead, provide will increase will possible be influenced by shifts in demand. Secondary markets and resort locations have been much less affected within the post-pandemic period, which implies that knowledge in future years might replicate a shift in sentiment or greater curiosity in growing in these markets, in comparison with city locations.

Based mostly on accessible knowledge from varied sources, the next desk illustrates historic provide knowledge, coupled with our forecasts for 2023 by 2025.

— Supply: HVS

Provide progress usually lags the market due to the time it takes for tasks to change into possible, acquire financing, and be developed. The tempo of progress in new provide following the 2009 downturn slowed considerably to an annual common of 0.4% from 2011 by 2013. Within the early post-recession years, resort income, web working revenue (NOI), and values declined to a stage that didn’t help new building. As soon as RevPAR and NOI reached a degree supporting feasibility, it took a number of years for tasks to acquire financing and be constructed. The tempo of latest provide progress greater than tripled from that trough to a median of 1.4% from 2014 by 2019, reflecting the resurgence of resort openings in these years, as illustrated above.

As talked about beforehand, provide decreased by 3.9% in 2020 because of resort closures. This was adopted by a rebound of 4.9% in 2021, which represents each the reopening of the closed lodges and the opening of the brand new lodges that had been already in superior levels of growth previous to the development stoppage. New provide peaked at 1.9% in the newest knowledge for 2022, representing roughly 102,000 new resort rooms. Nonetheless, much like the dynamic skilled within the post-2009 years, new provide progress is predicted to considerably reasonable to 1.0%, 1.2%, and 1.4% in 2023 by 2025. Previous to the onset of COVID-19, STR had initially projected new provide to develop by an annual common of two.0%; nevertheless, the impacts of adjustments in feasibility, provide chain points, value of debt, and rising building prices have lowered the variety of resort developments deliberate to return to fruition within the coming years.

— Supply: HVS

Whereas the aforementioned elements pose challenges for brand new resort growth, many visionary builders stay optimistic throughout instances of disaster. Resort growth can typically take three to 5 years to return to fruition, and as evidenced within the years instantly following the Nice Recession, new provide is usually sluggish to enter the market after a downturn. The restricted variety of lodges constructed throughout recessionary instances creates much less competitors for present and proposed lodges when the restoration and growth arrives. Moreover, tasks which can be capable of open within the subsequent years will profit from a brand new wave of demand that inevitably arrives after every cycle. Even when a resort shouldn’t be anticipated to open within the subsequent two to 3 years, a recessionary interval is usually the very best time to maneuver a undertaking ahead by the prolonged pre-development course of, which can contain market/feasibility research, entitlement efforts, structure, design, model/operator searches, and pre-construction. Furthermore, building prices can typically lower throughout a interval of correction, which may enhance undertaking feasibility if builders have the wherewithal to start their tasks throughout a slowdown.

CONSTRUCTION COST INFLATION

Within the wake of the COVID-19 pandemic, building prices skilled a big enhance. A number of elements contributed to this rise, together with labor points, provide chain disruptions, and different associated challenges. Initially, labor points emerged as many building tasks confronted labor shortages because of staff falling unwell, restrictions on motion, and/or security considerations. Authorities monetary incentives additionally lowered the variety of people keen to enter the workforce. This lowered workforce led to a rise in wages, together with extra time bills, to compensate for the decreased availability of labor.

The pandemic additionally triggered disruptions within the availability and well timed supply of building supplies. Lockdown measures, manufacturing unit closures, and transportation restrictions worldwide led to delays and shortages, growing the value of supplies. The elevated demand for sure supplies, resembling lumber, additional exacerbated these points.

Enhanced security protocols and hygiene measures had been carried out to guard staff from COVID-19, which added further bills. Building corporations needed to put money into private protecting gear (PPE) and sanitation provides and needed to modify worksites to adjust to well being pointers.

Lastly, the pent-up demand for building tasks post-pandemic contributed to elevated competitors and better costs. With delayed tasks resuming concurrently, contractors confronted greater bidding costs and elevated labor and materials prices, leading to inflated building budgets.

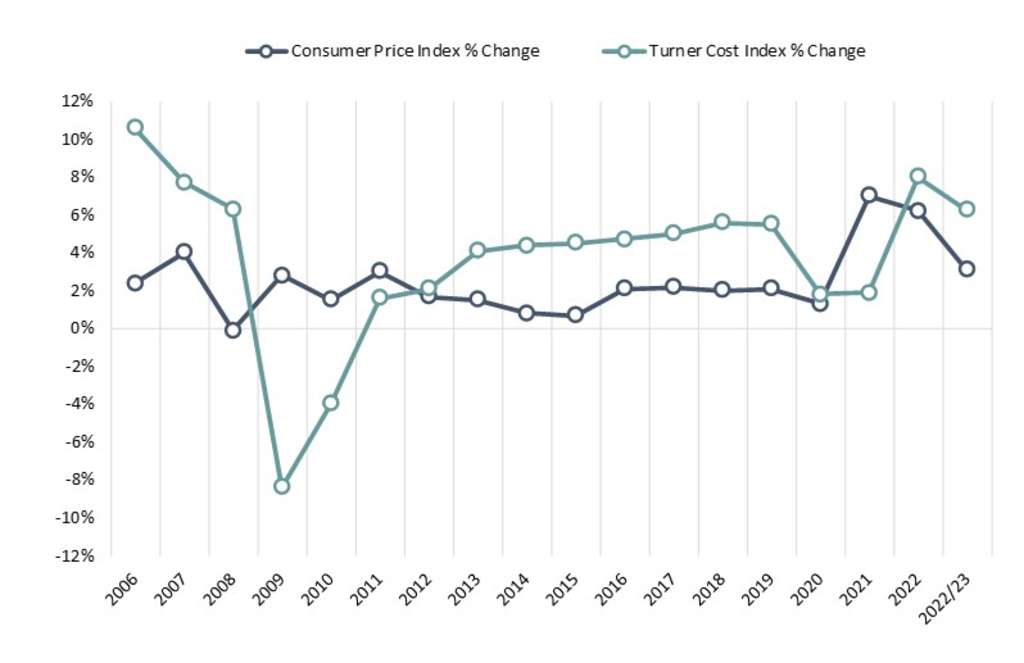

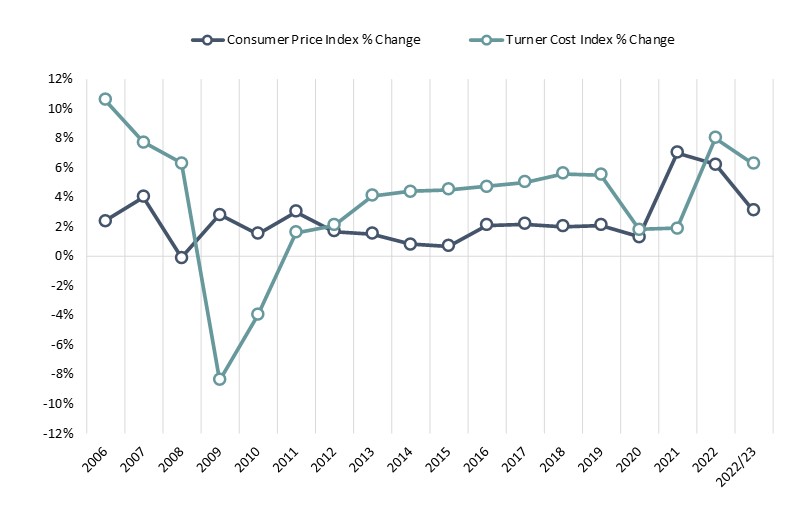

When it comes to inflation particularly associated to growth prices, under we current info from the Turner Constructing Value Index, which has tracked prices within the non-residential constructing building market in america since 1967. The Turner Constructing Value Index is decided by the next elements on a nationwide foundation: labor charges and productiveness, materials costs, and the aggressive situation of {the marketplace}. The index usually elevated year-over-year from 2011 by 2019, considerably outpacing inflation from 2013 by 2019. The index grew by 5.0% on common from 2014 by 2019 earlier than slowing to 1.8% progress in 2020 and 1.9% progress in 2021. Nonetheless, the price index surged 8.0% in 2022 and elevated an extra 6.25% within the 2022/23 trailing-twelve-month interval ending June 2023.

As an extra level of reference, Rider Levett Bucknall (RLB), which additionally compiles a quarterly building value report, reported a building value index enhance of 8.3% for year-end 2022.

The annual adjustments within the Turner Building Value Index in contrast with the annual adjustments within the Client Worth Index (CPI) are illustrated within the following graph.

— Supply: HVS

As proven above, the hole between common inflation and building inflation narrowed considerably in 2020, with common inflation outpacing building inflation in 2021; nevertheless, the Turner Value Index resumed its conventional dynamic of surpassing the CPI in 2022. It is very important be aware that value progress has been moderating within the 2023 year-to-date interval, much like the lower seen within the CPI. Whereas labor points stay an element, in addition to some provide chain points, prices for sure supplies, resembling lumber, plywood, and aluminum sheets, have decreased, offering some reduction to builders and contractors.

HOTEL DEVELOPMENT COST CATEGORIES

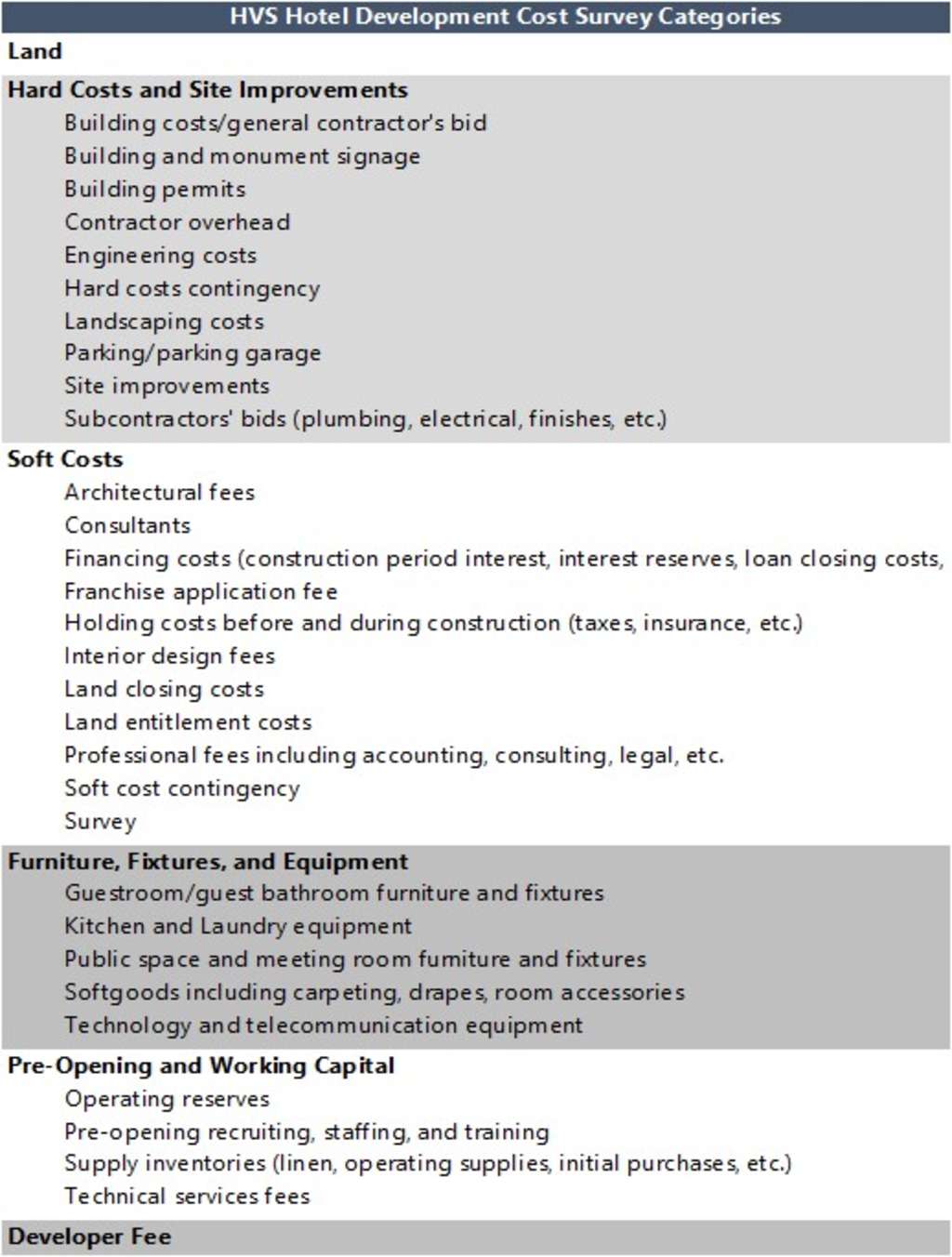

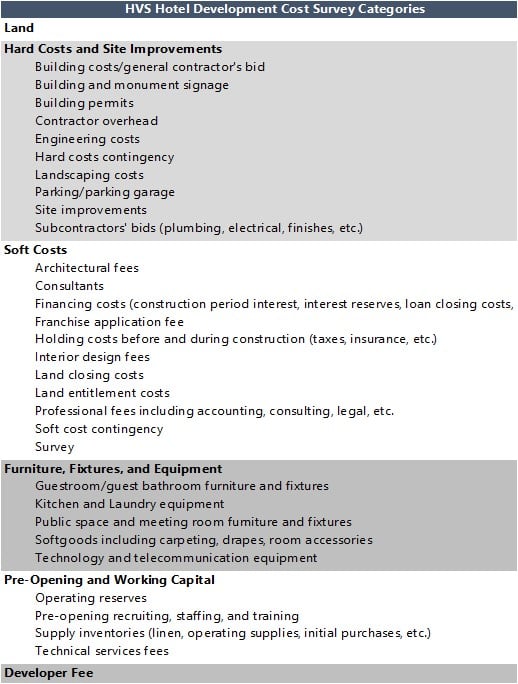

Evaluating the comprehensiveness of a resort growth finances can typically be difficult, as completely different line objects are used and a few parts are unintentionally omitted. HVS has been on the forefront of helping builders and business members make sense of resort growth prices by the constant presentation of those prices. Based mostly on our expertise reviewing precise builders’ budgets, in addition to getting ready the annual HVS U.S. Resort Improvement Value Survey, we have now created the next abstract format for resort growth budgets, which varieties the premise for the introduced value classes. We discover that these classes are significant for resort professionals when enterprise an evaluation regarding resort feasibility, they usually present a foundation from which to investigate proposed tasks. The next illustration reveals the six classes outlined by HVS, in addition to the standard objects related to every class.

— Supply: HVS

The classes will not be meant to be all-encompassing however do replicate the standard objects in a growth finances. In building accounting, growth budgets are generally introduced in far larger element than for common funding evaluation.

DATA COLLECTION AND SAMPLE SIZE

HVS collected precise resort building finances knowledge throughout 48 states in 2021/22. Whereas not each building finances was captured (because of quite a lot of causes, together with incomplete knowledge, skewed knowledge, or growth attributes), our choice contains full and dependable budgets that kind the premise for this 12 months’s survey. The budgets included each ground-up growth tasks and redevelopments of present buildings all through america. This 12 months, the states most represented within the survey had been Arizona, California, Colorado, Florida, New York, North Carolina, South Carolina, and Texas, illustrating the place the majority of resort growth is happening within the nation. Moreover, as will be anticipated, building prices fluctuate drastically in numerous components of the nation. On this pattern, the very best building prices on a per-room foundation remained in markets with excessive prices of residing, primarily California, adopted by New York. Nonetheless, quite a lot of high-end luxurious developments had been additionally famous in Florida and Colorado. Developments with the bottom prices per room included limited-service or financial system extended-stay lodges in Solar Belt states.

We additionally examined the lodging product-tier breakdown of our knowledge to additional decide the most well-liked varieties and types of lodges that had been developed in 2021/22. Within the limited-service class, the highest 5 manufacturers had been Fairfield by Marriott, Hampton by Hilton, Tru by Hilton, Finest Western, and La Quinta. Throughout the extended-stay class, the highest 5 manufacturers had been Home2 Suites by Hilton, WoodSpring Suites, TownePlace Suites by Marriott, Homewood Suites by Hilton, and Staybridge Suites. The select-service section was most represented by manufacturers resembling Courtyard by Marriott, Hyatt Place, Hilton Backyard Inn, EVEN Motels, and Tempo by Hilton. Lastly, the full-service class was most represented by quite a lot of “assortment” manufacturers from Marriott, Hilton, and Hyatt.

PER-ROOM HOTEL DEVELOPMENT COSTS

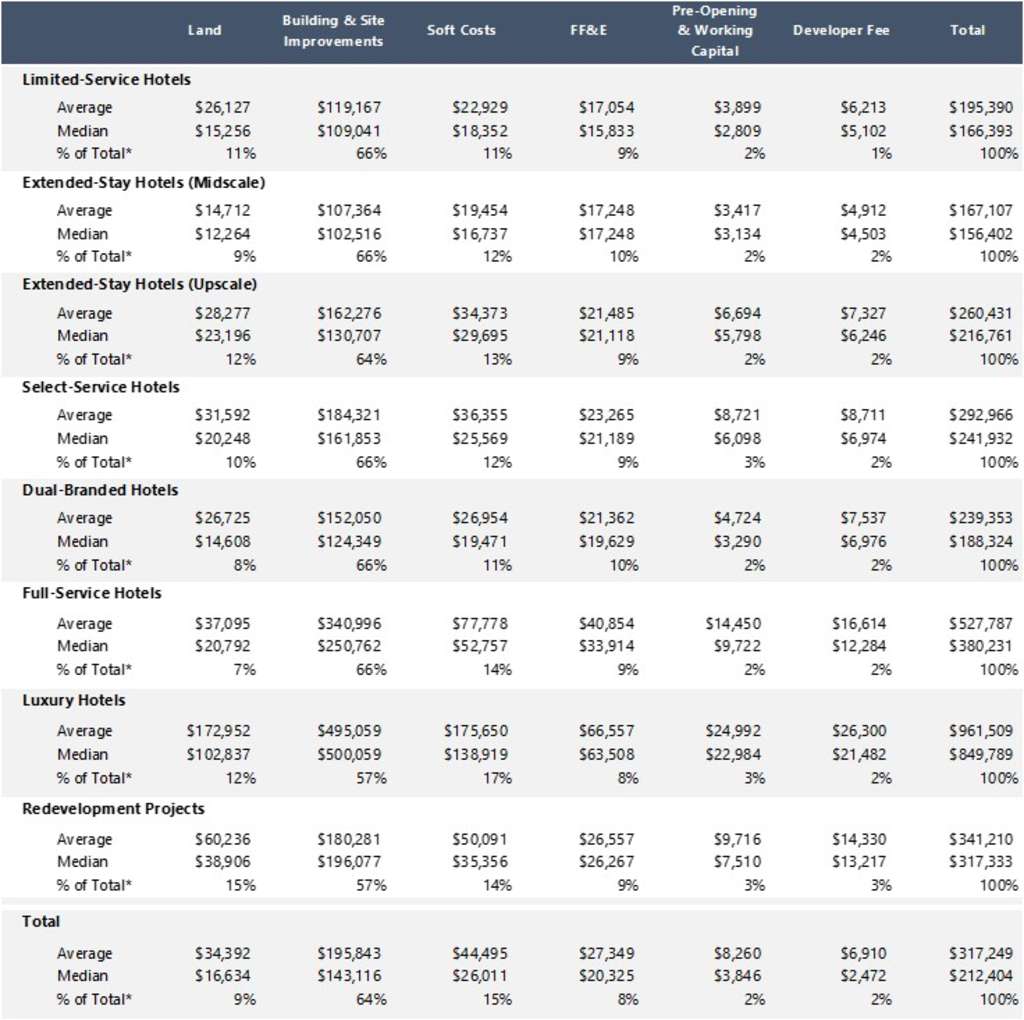

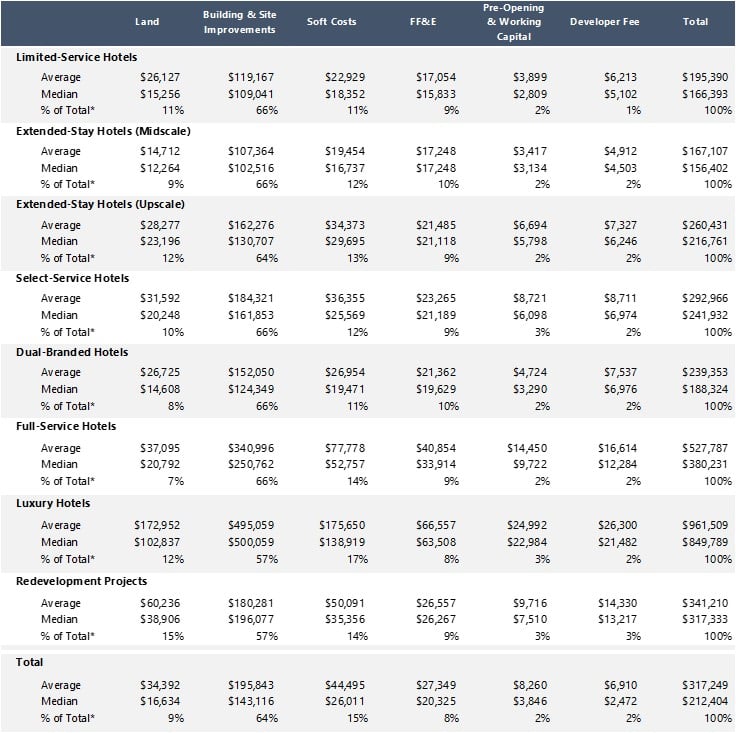

The averages and medians under replicate a broad vary of growth tasks throughout america, together with tasks in areas with low boundaries to entry and people in high-priced city and resort locations.

— Supply: HVS

Restricted-service and midscale extended-stay lodges illustrated median prices per room within the $150,000 to $170,000 vary and included the favored manufacturers beforehand highlighted. The median value for lodges within the upscale extended-stay class was simply over $200,000 per room. Twin-branded lodges confirmed a median of $188,000 on condition that this class typically contains an extended-stay midscale or upscale model coupled with both a select-service model or a limited-service model.

Choose-service lodges mirrored a median value of $242,000 per room. The price to develop full-service lodges is roughly $140,000 per room greater than select-service lodges, with a median value of over $380,000 per room.

Lastly, the median value to develop luxurious lodges was recorded at almost $850,000 per room. This class mirrored the bottom variety of developments given the arithmetic of constructing luxurious tasks possible throughout the nation with such excessive growth prices.

It is very important be aware that the median value for all lodges elevated roughly 20% when in comparison with the outcomes of our final survey. As talked about beforehand, this survey contains knowledge obtained in the course of the 2021 and 2022 calendar years, as in comparison with our final survey, which included knowledge from solely the 2020 calendar 12 months.

IN CONCLUSION

The budgets analyzed on this survey had been offered instantly by the builders, homeowners, and lenders on each ground-up and conversion resort tasks in the course of the illustrated interval. The outcomes of the survey mix the info from precise building budgets organized throughout quite a lot of product varieties. The outcomes additionally comprise distinctive resort tasks that can’t be replicated by the inherent nature of resort growth. As such, we might warning builders towards counting on the knowledge to estimate prices for a selected undertaking, as a large number of things have an effect on a resort’s growth finances. Thus, we advocate that customers of the HVS U.S. Resort Improvement Value Survey think about the per-room quantity within the particular person value classes solely as a common information for that class. Building and FF&E design and procurement companies are the very best sources for acquiring laborious prices and FF&E prices for a selected resort undertaking. Additionally it is suggested that builders seek the advice of multiple supply of their resort growth course of to extra precisely assess the true value of growth. Moreover, the price ought to at all times be adjusted for inflation over the event timeline on condition that the standard resort growth course of can final three to 5 years. Lastly, we advocate that the projected efficiency of the proposed resort be revisited periodically in the course of the growth course of.

All particular person property info utilized by HVS for this value survey was offered on a confidential foundation and deemed dependable. Knowledge from particular person sources, manufacturers, or areas will not be disclosed.

Different contributors: Kathryn Lutfy, Koby Kearny, Lizzette Casarin, Astrid Clough McDowell, Stephanie Nettles